Table of Contents

| Year | Principal | Total Amount |

|---|

Calculate Savings and Grow Your Money Fast

The savings calculator tool by Calculator Suite is a simple and lightweight free online calculator that helps you calculate:

- how much your savings account earn by interest rate

- how much money you need to save for something

If you are considering a savings account and would like to see a complete breakdown of the interest accrued over a period of time, this tool helps you do just that.

If you have a savings goal, you can use the tool to calculate savings over a period of time for the most important occasions in your life such as:

- How much money you need for retirement

- How much money to save for a baby

- How much you need to save for a vacation

- How much money you need for college

- How much you need to save to buy a car

- How much to save from your salary every month

- And so much more!

This free calculator tool also helps you to answer how much savings you need to keep from your total salary to maintain your desired lifestyle at different age milestones.

For instance, if you have ever asked yourself:

- How much savings should I have at 20?

- How much savings should I have at 30?

- How much savings should I have at 40?

- How much savings should I have to retire?

Then this online savings calculator can give you a complete breakdown of your savings over a period of days, weeks, months and/or years.

Try the free online savings calculator tool and get a better view of your savings plan in just a few clicks.

How to use Calculator Suite's Free Online Savings Calculator

This tool may look like a simple savings calculator but it has added capabilities to formulate calculations for many different savings goals using different methods.

For example, this tool can help you calculate your savings with:

- Initial deposit

- Monthly deposit

- Interest rate

- By percentage

- By ratio

- Over daily/weekly/monthly/yearly

- Length of time

- Your savings goal

To start calculating your savings, follow these steps:

- Input your initial deposit

- Input your interest rate

- Define the length of time you prefer

- Click on any additional options to customize

The calculator then gives you the total amount of final accrued savings and the exact date it ends based on the length of time you have chosen.

Below the results, it also gives you a table of the total breakdown of your savings over a period of days, weeks, months, or years you have chosen.

How do I save money faster?

Okay, so you've used the calculator tool and now have an overview of what your savings should look like. But sometimes you still wonder - is there a better, much faster way to get to your goal?

Here's the reality: 56% of Americans can't cover a $1,000 emergency expense with savings.

So the usual advice you'll receive is always to either save more. Yes, you could always:

- Buy less meat at the grocery store

- Cancel a few subscriptions

- Cut down on energy use at home

- Spend with coupons

- And others

And if all these fail, then the natural next step is to earn more.

- Sell your unwanted items

- Freelance

- Start a side hustle

And if that still fails, the best way to keep up with savings is to completely change the way you think about money or your relationship with money.

Here are five of the best psychological tricks to save money fast when all else fails:

- “Don't buy it now. Buy it tomorrow.”

When you choose to buy it tomorrow over and over again, the anticipation wears off and you no longer get excited over the purchase. - “Would I rather receive the cash value of this item over the item itself?”

If your answer is yes, that means you don't really need the item in question; you just like the idea of having the item. - “How many hours will it cost me to pay for it?”

When you exchange your purchases in equal value to your working hours and nonrenewable time in this life, you will start treating your spending habits very differently. - “Don't buy this item but instead put the same dollar value into another account.”

When you start putting the same amount of money into a different account, you'll start seeing immediate results of cutting back. - “What could this money be worth in the future?”

Inflation is a real thing and you need to protect yourself against it. If you invested that money with compound interest instead, that $50 could turn into $400 in the future.

How much should I save every month?

There are many ways to calculate how much you should save depending on how much you earn, what you're willing to sacrifice, and what you're saving for.

The basic way to do a savings calculation is to take (income - savings) x days/weeks/months/years.

If you're wondering how much you should save from your salary every month, Investopedia perhaps has one of Internet's most simple answers to this:

"The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings."

Example: if your after-tax income is 1,000 then your needs are 500, wants are 300, and 200 goes to savings.

The 50-20-30 method is the most basic savings ratio out there. However, this is quite a generic savings ratio and not everyone will be able to achieve their desired savings using this method.

CalculatorSuite's free savings calculator goes beyond the basic 50-20-30 method to give you a more robust and accurate calculation over a period of time.

Download savings calculator in Excel

However, if you prefer to calculate your savings using a different tool, we have also created an easy-to-use, free downloadable Excel file with the same formulation and capabilities as the CalculatorSuite Savings Calculator.

Click to download: Free Savings Calculator Excel file

How does a savings calculator work?

Savings calculators are a useful financial planning tool. A tool that is used by many people whether they are just starting out in life or if they are already on their way to retirement. A savings calculator helps you to weigh up the pros and cons of investments. It examines the benefits of having a certain amount of money to invest as well as the potential risks.

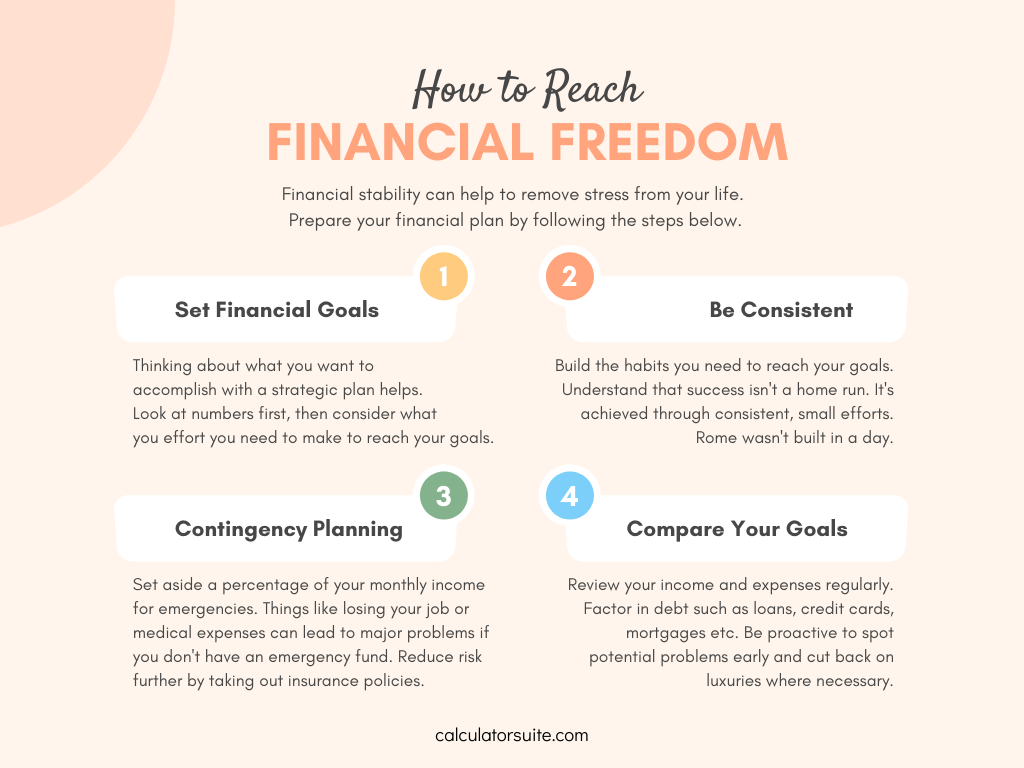

Do I need a savings plan to reach financial goals?

Saving money might seem like a difficult thing to do. There are a lot of factors that play into it, including how much you earn, how much debt you have and how much you spend each month. This is why we've created a savings calculator that will help you figure out how much money you need to save to reach your financial goals.

Whether you want to buy a house or travel the world, this calculator will take into account your current pay, how much debt you have and how much you can spend without getting yourself into trouble financially. One of the best part's is that it can help you figure out how much you need to save each month and how long it will take you to reach your goal.

What are the benefits of using a savings calculator?

Most people know that in order to reach any kind of financial goal, it takes a lot of time and it takes self-control. This is where a savings calculator can help.

With a savings calculator, you can plan your financial future and reach financial milestones faster. Most people know that in order to reach any kind of financial goal it takes time and self-control.

The good news is that by using a savings calculator, you can plan your financial future and reach financial milestones much faster. One of the most common accounts for those who are new to saving is a fixed deposit savings account.

With the help of a fixed deposit savings calculator you can get a "snapshot" of your financial future. It's a tool that helps you by showing your current financial situation and the amount of money you will need to save to reach your future goals.

The best thing about a savings calculator is that it helps you to plan your financial future while you're working towards your goals.

Why is it important to have a savings account?

Most people know that saving for your financial future is important, but very few actually know when to start saving and how much of their income to save.

In order to help people set savings goals and plan their financial future, we've created a free savings calculator. It's a tool that helps you plan your financial future based on how much you can save per month and how much of that money you want to invest. It's a simple way to plan your financial future and reach your financial goals.

How can I save money?

When it comes to saving money to help reach your financial goals, most people have the same question: how much should I be saving? The answer depends on a variety of factors, including the amount of debt you have, your current income, and your financial goals. Spending less than you make is a great way to get back on track.

The first step to getting started with your savings is to figure out how much you can afford to save and making a commitment to set that money aside each month.

What is compound interest?

If you want to be wealthy, you need to save. There's no way around it. If you want to increase your net worth without selling your time for money, then you need to start saving as early as possible. This brings us to the topic of compound interest.

You may have heard of compound interest before, as it is one of the most powerful and effective ways to build long term wealth. You can use a compound interest calculator and see how it can be used to increase your savings over time.

FAQS

Savings refer to the portion of income that is not spent on consumption and is instead set aside for future use. It can be kept in various forms, such as cash, bank accounts, investments, or other financial instruments.

Saving money is important for several reasons:

- Emergency Fund: Provides a financial cushion for unexpected expenses or emergencies.

- Financial Goals: Helps achieve long-term goals like buying a home, education, or retirement.

- Financial Security: Provides a safety net in case of job loss or economic downturns.

- Investment Opportunities: Funds available for potential investments and wealth-building.

- Peace of Mind: Reduces financial stress and provides peace of mind.

Common methods of saving money include:

- Opening a savings account in a bank or credit union

- Investing in stocks, bonds, or mutual funds

- Contributing to retirement accounts like IRAs or 401(k)s

- Building an emergency fund in a liquid, accessible form

- Automating regular contributions to savings

- Cutting unnecessary expenses and budgeting

The amount you should save depends on your financial goals, income, expenses, and risk tolerance. Financial advisors often recommend saving at least 10-15% of your income, but this can vary based on individual circumstances and objectives.

An emergency fund is a savings account set aside for unexpected expenses or financial emergencies. It is typically recommended to have enough funds to cover three to six months' worth of living expenses, but the exact amount may vary based on individual circumstances.

Even with limited income, you can start saving by:

- Creating a budget to track and manage expenses

- Identifying areas where you can cut unnecessary spending

- Automating small, regular contributions to a savings account

- Exploring low-risk investment options

- Seeking additional sources of income or side gigs

Both saving and investing serve different purposes. Saving provides safety and accessibility for short-term goals and emergencies. Investing offers potential for higher returns over the long term, but comes with higher risk. A balanced approach that includes both saving and investing is often recommended for a well-rounded financial strategy.